The latest real estate market report is out, and we might be starting to see the peak of this craziness.

I haven’t done a real estate market report blog since October, mostly because it’s been the same thing over and over. You’d have to live on an island to not know we’re in a housing rush! So why now? Because it’s time to check in and see if we’re starting to see the end. But first, let’s dive into the data…

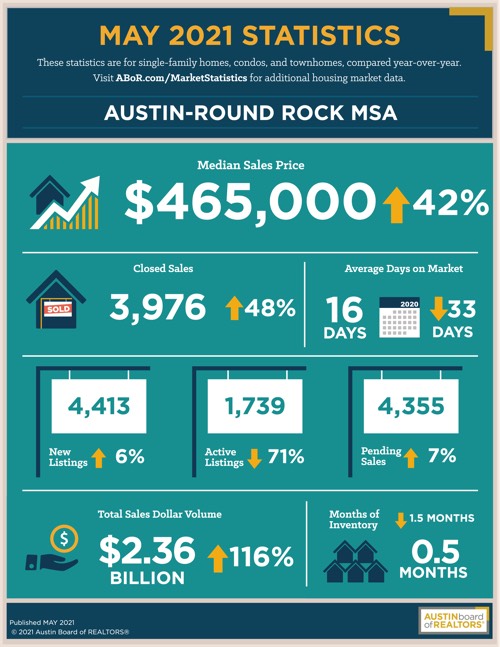

Median Sales Price

We all love this number, as it means our real estate net worth is up 42% YoY (on average). After all… that’s why we’re in this business, right? Last month’s number was $460k, so we’re still continuing to climb.

New/Active Listings

The YoY percentages are useless, but both New and Active listings dropped Month-over-Month (MoM), which continues to point to limited supply. However, the slowing of new listings (remember, most sellers are also buyers), can be indicative of a slowing demand.

Months of Inventory (MOI)

This is the metric to watch. A healthy and typical inventory is about 3 months for Austin, and we’re currently at 2 weeks. This is unchanged from last month, so the market isn’t getting worse, but isn’t getting better yet either.

What’s driving this demand?

Though I’ve harped on how low-rates, people who sold and are now desperate to buy, and a gluttony of out-of state buyers have driven up prices, there is another player in the market contributing to the frenzy… institutional investors. The same low rates that we enjoy with cheap mortgages, make it harder and harder for fund managers to provide stable fixed-income returns to their clients (retirement funds, pensions, etc). With CD and savings rates significantly below 1%, they can’t even keep up with inflation. A typical cap rate (in a normal market) for a single-family residence in Austin is around 5%. Even if they were to pay twice as much for a home today (without raising rent $1), they’d still have a cap rate of 2.5%. Sure, that’s not as good of a return as 5%, but it’s 4x what they could get with a CD.

Institutional investors also now account for 20-30% of all home sales, simply because they can. While you and I have to pay 3% for a mortgage, a bank or large investor is essentially paying cash. The typical interest charge that tightly controls our profitability, isn’t an expense for them. This means they can effectively pay whatever they want for a home, even if the rent is terrible, and still make money!

When will it be over?

Ah… the million-dollar question! Eventually buyers and sellers will balance out, once everyone moving is comfortably situated. Out-of-state money (mostly CA) will eb and flow with corporate investment, but eventually the Teslas, Apples, and Oracles will stop expanding and stop hiring. The real number to watch is interest rates, because they do double-duty. As rates go up, fewer and fewer normal buyers (you and I) can afford a mortgage, so buying interest will decline. It also means that institutional investors can get a better return elsewhere, so they will slow their thirst for real estate.

I believe we are starting to see a peak right now. That doesn’t mean we’re about to drop (far from it), but we’re probably not getting worse. I suspect the current market will play out through July, then slow slightly during the fall season, when buyers seasonally dry up after school starts. The HUGE inventory shortage with builders will likely continue through the first or second quarter of next year, then start to settle to a healthy balance of supply/demand. I fully believe Austin will have a very soft landing when all is said and done mid next-year. Regardless of the price paid, people aren’t moving out of Austin, so probably the most we’re going to see is a brief pause, then resume our normal healthy appreciation we’re all accustomed to.

Summary

The latest real estate market report is out. While prices continue to climb, it looks like we’re approaching the top of the market. As seasonal buyers dry up, all eyes will be on the Fed for what they do with interest rates. If left unchanged (as is widely expected), this market should slow to a soft stop sometime mid next year.

Happy hunting!

Read more real estate investing articles like this on the Ten Properties blog