As part of a settlement to end a class action lawsuit, The National Association of Realtors (NAR) agreed to make massive changes to the way buyers’ and sellers’ agents make and share commissions on real estate sales. Unfortunately, the national media has dramatized and grossly mischaracterized the settlement with headlines such as, “Realtors Agree to Axe 6% Commissions” and “New Ruling Could Mean the End of Realtor Commissions.” While the settlement will bring much needed reform to the industry, its unclear whether it will actually result in cost savings and service improvements for home buyers and sellers.

First, let’s start with the facts. The settlement did not include any agreement to change commission rates. In fact, NAR has never set guidelines or mandates related to commission rates. Buyers and sellers have always been free to represent themselves, and commissions have always been negotiable. What the settlement did change is that beginning mid-July 2024 it:

- Prohibits offers of compensation on the MLS

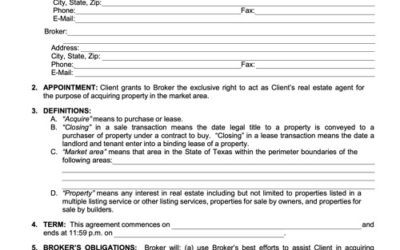

- Requires written agreements for REALTORS® working with buyers

Let me address the second point first. Buyers’ representation agreements have not been required in the past, but buyers and agents who chose not to use them were reckless. In practice, when an agent doesn’t have a contractual agreement with a buyer, they operate as a sub-agent to the seller’s agent. This means they have a fiduciary duty to the seller not the buyer. An agreement on the buy-side ensures loyalty and confidentiality between the buyer and their agent. It also specifies in writing how buyer’s agents will be compensated, which ensures alignment of their interests and prevents disputes. It blows my mind that some buyers and agents were still operating without written agreements, and the requirement for them to be used universally is well overdue.

Let’s now look at the first point, which sounds mundane on the surface but is what truly has the potential to shake up the industry. The prohibition of offers of compensation on the MLS will effectively break up the monopolistic cartel that the National Association of REALTORS® has maintained for years. This is a good thing! For decades, this practice, which NAR called “cooperative compensation,” made agent compensation unnecessarily opaque and ensured that buyers’ agents were paid substantial commissions even in deals in which they did very little work. This was frustrating for sellers, who were required to pay the buyer’s agent commission, buyers who indirectly pay for it through higher purchase prices, and the truly competent agents who were working harder but getting paid the same as the shoddy ones.

In theory, there were some positive aspects of the cooperative compensation arrangement: most notably that it lowered the required cash to close for buyers. Even if seller-paid commissions resulted in higher sale prices, this allowed buyers to effectively roll the added cost into the mortgage and amortize it over 30 years. If buyers are required to pay their agents directly, it could dramatically increase the required cash to close. For example, if a buyer putting 5% down on a new home must now also pay their agent 3% commission, it increases their required cash to close by 60%! For a $500,000 home in Austin, this means bringing $40,000 to the closing table, instead of $25,000 (before adding other closing costs). This could make it particularly difficult for first time homebuyers, who are already struggling to break into the housing market with high prices and mortgage rates. The alternative is for buyers to represent themselves or utilize a low-cost broker, but as the saying goes, “excellent service is expensive, but bad service can cost a fortune.” First-time homebuyers, more than anyone, need guidance navigating a complex process which is undoubtedly the most expensive undertaking of their lives.

If you are an investor or experienced buyer, you should always consider the cost of buyer’s representation and do your due diligence to understand the quality of service you expect to get and how much you are willing to pay for it. The vast majority of REALTORS® don’t understand financial metrics such as NOI, cap rates, or return on equity; and don’t understand business and tax law. If you are relying on advice from an agent, make sure that you are getting what you pay for.

Personally, I know how to do my own taxes, but I’ve always paid a CPA. I am currently in the process of switching to a CPA with a higher hourly rate, because I want guidance on more advanced tax planning and strategy, rather than just preparation of my returns. Even though it’s within my rights, I would not dare represent myself in court. A good attorney is worth their weight in gold. Commercial acquisitions almost never happen without professional representation. And for the vast majority of real estate buyers, finding a great agent to guide and represent you through the process is well worth the cost.

This legal ruling and the subsequent settlement will bring much needed change to the real estate industry by making the sales process more transparent and ensuring better alignment of interest between the parties involved. It will force real estate agents to ensure they provide excellent service, and less proficient agents won’t be able to compete. These are good things for all of us. The reality is that buyers and sellers have always been able to represent themselves in a real estate transaction, but only a tiny fraction choose to do so. Online and discount brokers such as RedFin promised to revolutionize the market, but their market share has actually been declining. This settlement will force brokerages and the market as a whole to adapt their practices and improve their business models. I don’t expect commission rates to drop dramatically, but I expect (and you should too) for the level of service from buyer’s agents to improve. There is no more free lunch for crappy agents.