Should you sign a Buyer Representation Agreement with an agent? With so much at stake, wouldn’t you want to know who has your back?

While not explicitly required in order to establish a client relationship, most good real estate agents will insist on having a Buyer Representation Agreement in place before showing any properties to their client. The common misconception is this is needed so an agent can get paid, which is simply not true. An agent can get paid whether there is an agreement in place or not.

So why do agents ask their future clients to sign these agreements?

One simple word… Protection. This agreement protects BOTH the client and the agent. By formally establishing a client-agent relationship, the client is assured of the responsibilities (called “fiduciary duties”) due to them by the agent. In kind, the agent is assured that the client will stick with them for the duration of the process. A good agent will put in a ton of work for a client to find a home. Imagine what level of work an agent would invest in you if they didn’t know you were going to stick around!

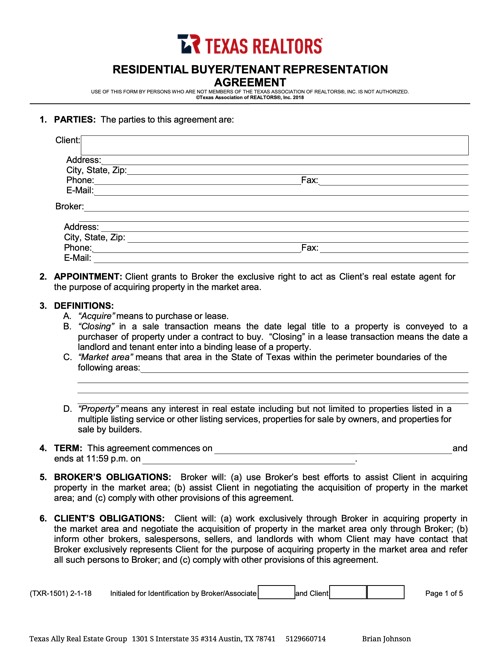

That said, the standard Buyer Representation Agreement that most agents in Texas use is 5 pages of legalese that trips up clients more than it helps. These are the parts that warrant extra time understanding.

Section 4 – Term

This is here simply to establish the duration of the contract. My clients know that I NEVER lock them in for any pre-determined length of time, and I don’t understand why any agent would do so. In fact, I replace the end date with “TBD by written notice of Client/Broker” in all of my contracts. If my service isn’t exceeding a client’s expectations, it does neither of us any good to keep the agreement going.

Section 11.B – Source of Commission Payment

This is easily the #1 section I get questions about. Simply put, the agent’s commission is paid by the selling party, which means it doesn’t cost you a penny! However, it goes on to say that if the selling party doesn’t pay a commission, the client is responsible. Seriously??? Yes, but let me explain. All MLS-listed properties have a pre-determined broker-to-broker agreement in place in order to play in the MLS, so this isn’t an issue. The only case where this becomes a concern is with non-MLS properties, such as For Sale By Owner (FSBO). An FSBO has no listing agent/broker and is therefore under no obligation to pay a commission. Some do and some don’t, it just all depends on the seller. What I tell my clients is that if we ever found ourselves in this situation, I would let them know before we spent any time on it, and then decide if/how to move forward.

Section 11.G – Protection Period

This is the section that protects the agent’s investment in the event the client decides to terminate the agreement. Like I mentioned earlier, I NEVER lock in a client for a pre-determined period on a contract. Instead, I simply base the protection on a property-by-property basis. Simply put, if it’s a property I’ve brought to the table or that we’ve discussed, it’s protected for a period of time after the contract terminates.

Conclusion

Should you sign an agreement with an agent? Real estate investing is expensive, and with so much on the table, wouldn’t you want to know that your agent has YOUR back? Likewise, that you have theirs? At Ten Properties, we require all clients to be under contract. Period. There is simply too much at stake not to be all in.

Read more real estate investing articles like this on the Ten Properties blog