The whole process of new construction can seem intimidating. While there is definitely a bit more work involved than buying a re-sale home, it is generally pretty straightforward. Additionally, the contract process is simpler, and in the end you get a brand-new home, hand picked, and with a warranty!

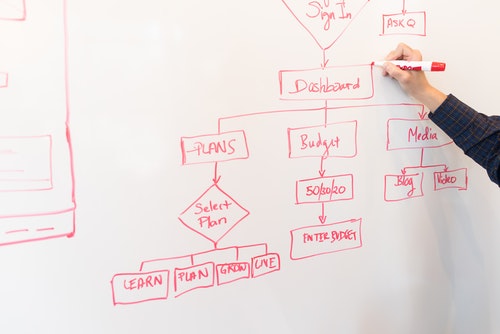

Once you’ve picked your subdivision and are ready to take the next step, I recommend a process flow like this:

- Sit down with your sales agent and pick your plan and your lot. Also talk about what features are included with the house as well as any extra features you may want.

- VERY IMPORTANT. Before leaving that meeting, ask what the lot-hold policy is with the builder. Sometimes a simple $500 will hold the lot for a couple of days while you work out the contract. Some builders don’t do lot-holds and are first-come, first-served. That being said, the agent you’re working with only gets a commission if you buy, so it’s in their best interest to protect the sale. In this case, tell the agent that you want to move forward on that lot and that you will be submitting your offer by XX date and ask if she hold it until then. More often than not, an agent will “unofficially” take the home off the market for a day or two by telling the other sales agents that it’s about to go under contract. I’ve seen countless times where buyers didn’t know to ask, only to walk in the next day to find the lot they wanted gone.

- Work with your realtor to help negotiate the final contract.

- If you like the final contract, you sign. Congrats, you are under contract!

- If the builder offers an incentive to use their lender, work with them to get a quote. It’ll often be part of the contract that you must secure funding approval within a certain timeframe or the contact becomes void, so work on this soon after signing. If the lender’s offer stinks, shop around, but keep in mind the incentives you may have to give up by going with your own lender.

- Wait and wait. It’ll get built eventually. During this time you will be working with the lender and the title agent who will reach out to you shortly after going under contract.

- VERY IMPORTANT. About two months before scheduled completion, ask your sales agent when you can schedule the 3rd-party inspection. They may try and talk you out of it saying they do their own inspections, but politely tell them you will get your own anyways. Schedule the inspection (typically 2-3 weeks before closing) with a good, highly-rated inspector. This is not an area you want to save a couple of bucks in.

- Meet with the inspector (typically at the end of the inspection) to go over everything they found. They will email you an inspection report and you can forward that report on to your sales agent who will pass it on to the construction manager.

- Do your first walk-through with the construction manager. They will typically have a printed copy of your inspection report and will walk through each item line by line. Some of the things the builder may choose not to fix, but most of the time they say OK. This is where the 3rd-party inspection really pays off. That report can be 30+ pages long with pictures and detailed notes. Imagine if you had to find all of that yourself!

- I recommend scheduling a follow-up inspection as well. These are quicker and cost a fraction of the original inspection price and basically ensure the builder fixed everything they said they were going to fix. Ask your sales agent or construction manager when everything will be ready for a second inspection and get it scheduled and complete.

- Do your final walk-through with the construction manager. If all goes well, they will have fixed everything and will walk through the inspection report again with you, checking off each item. Rarely, though, do they get everything done in time. VERY IMPORTANT. For any item that will not be complete by closing, get them to add it to their “exceptions list” and ask them to send you a copy of that list. That way you have it on record that they need to fix these items after closing. I like to go a step farther and forward the list on to the title agent for inclusion at closing. Sometimes this happens automatically, but I tend to not trust the system.

- About 3-5 days before closing, your lender will send you the final Closing Disclosure form which outlays all the costs involved in the transaction. Review this in detail and ask your lender, title agent, or realtor for help if you don’t understand anything on this document.

- Wire funds to the title company. Your Closing Disclosure will list the “Cash to Close” amount. Confirm this with the title agent, as well as their wiring instructions.

- Close on the house. Congratulations, it’s ALMOST yours. The loan has to “fund” before it’s officially yours. I like to schedule my closings early in the day so that everything can happen in the same day.

- The title company will let you know once you’ve “funded” and the house is now yours. The keys will typically be with the sales agent, so you can stop by anytime after funding and pick them up.

- Celebrate!