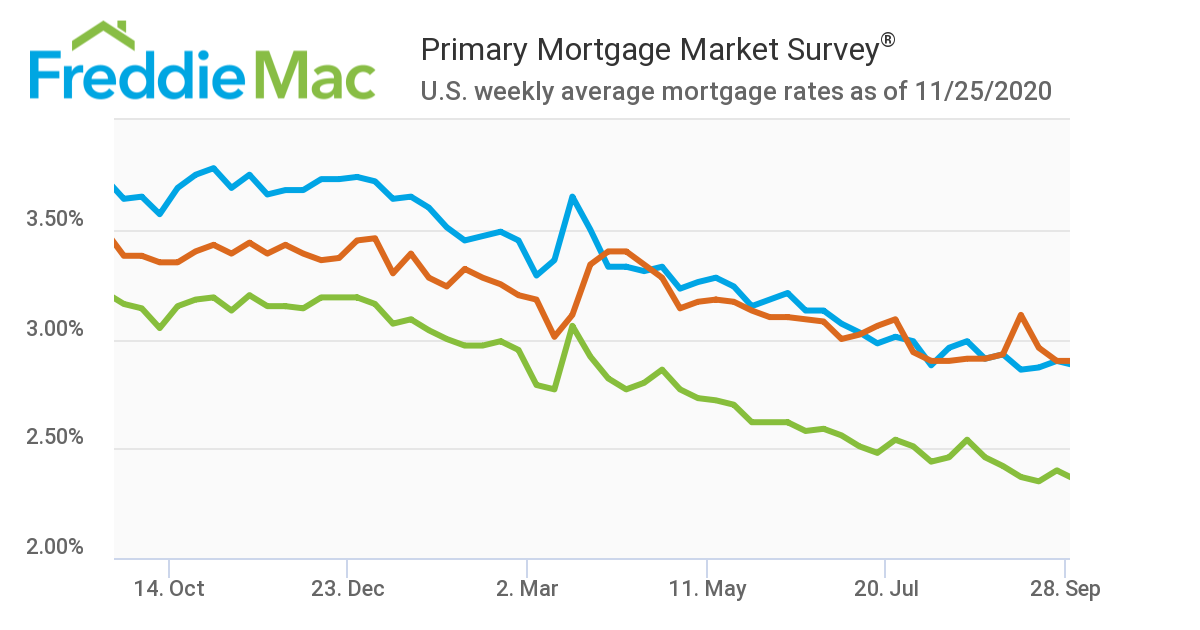

Real estate mortgage interest rates are at unprecedented lows despite a booming stock market.

I follow a really good mortgage blog, and today’s topic was a deeper discussion on real estate interest rates and their non-correlation to today’s stock market. I’ve written before about how mortgage rates generally follow the 10-year US treasury bond. When the economy is booming, investors tend to favor the growth potential of stocks over the security of bonds. This causes the price of bonds to drop (less demand) and the interest rate to rise (bonds have an inverse price/rate relationship). So in a normal year, a strong stock market tends to equate to higher interest rates for mortgages.

This year the opposite seems to be true. The Dow crossed 30,000 for the first time in history, despite a global pandemic and election year. If there was ever a time for uncertainty and security, you’d think this would have been it!

The reason is our good old Federal Reserve. To help curtail an economic landslide, the Fed has been buying up Mortgage Backed Securities (MBS) through a program called Quantitative Easing. MBSs are what fuel the real estate market and allow us to get loans so cheap. Instead of banks lending you their own money (and wanting whatever rate they feel like charging), the loans are instead packaged and sold on an open market, thereby keeping prices low and liquidity high. To further sweeten the deal, the government insures these loans to ease the risk of default on banks, causing them to lend more, causing more MBS sales, and the process repeats.

This year, through the Fed’s quantitative easing program, the extra buying of these MBSs has created an extremely liquid lending market. And as you know, when supply increases, prices fall, and that’s exactly what we’re seeing! Obviously this can’t go on forever, and it’s anyone’s guess as to how low rates will go. But I just locked on another property at 3.125%, and that just blows my mind for an investment property!

And there you have it for today’s lesson in real estate economics. Happy hunting!

Source/credit: JVM Lending. Freddie Mac

Read more real estate investing articles like this on the Ten Properties blog